The Self-Directed IRA Investing — Myth or Fact?

By IRA Advantage, Portland OR

The following are common objections to using IRA/401k funds for real estate investments. Here are the truths:

- Personal Use– You cannot personally use property owned by your IRA.

Correct, any benefit to a plan’s owner from an investment prior to its distribution would be considered a prohibited transaction. This is not unique to real estate investments with plan assets. That said, real estate investors typically do not use the property for personal use anyway. The ability to use your IRA or other plan assets as a source of funds and to acquire real property as an investment is the goal. Personal use of the asset should not be an issue any more than it would be for any other investment regardless of the source of the funds.

- Expenses– You can only use IRA funds for all expenses associated with the property.

True, the property typically must be maintained with either proceeds generated from the asset or with plan assets that were set aside initially to cover these expenses. It is possible to add funds, within your annual contribution limits, in the event the real property or other investment assets requires additional funds. That said, it is important that investments in real estate using qualified funds are done conservatively with suitable reserves.

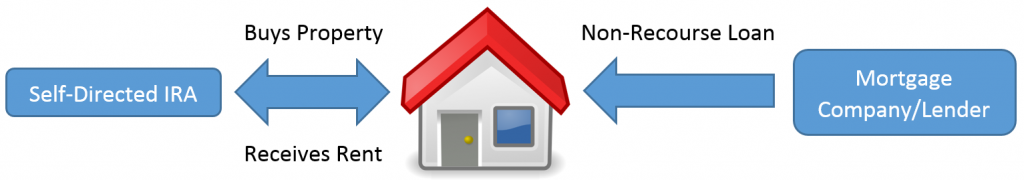

- Unrelated Business Taxable Income (“UBTI”)– If you purchase Real Estate within your IRA using a mortgage, you may be subject to UBTI. This may require filing a tax return and paying taxes on the income or gain attributable to the leveraged purchase price.

True, though at least you can make leveraged investments in real estate with an IRA. UBTI is not a reason not to make an investment; it is just something to be aware of and to factor into the final analysis of whether an investment is going to be suitable. In the end, the ability to leverage allows you to acquire assets that are otherwise outside your reach. Even with UBTI and the resulting additional tax, you’re IRA is able to take advantage of the post-tax gain you otherwise would not have been able to enjoy. For those investors using a 401k, this issue does not exist.

- Liquidity– You would need to have enough additional funds in the IRA to take the Required Minimum Distribution (“RMD”) every year starting at age 70.5. Which is not easily done if all of your IRA is invested in real property.

Wrong! Though Real Estate is not exactly liquid and a sale may take time, RMDs can be satisfied through in-kind distributions, i.e. you do not have to distribute cash from your IRA. You can simply take an ownership interest in the property as an in-kind distribution.

- No step-up in basis– If property owned (directly) is inherited, heirs receive a step-up in basis and could sell immediately paying no tax. If property is in an IRA, there is no step-up in basis

Wrong Again, all IRA assets are treated the same whether discussing stocks or real estate. If your IRA assets are invested in “traditional” investments, i.e. stocks and bonds, you still do not receive a date of death step-up in basis and this should not factor in when weighing your investment choices.

- Custodial Fees– If you want to invest in real estate, you’ll have to find a custodian that specializes in holding real estate and that will cost a lot of money.

All IRAs are exposed to custodial fees whether those fees are embedded in a custodian’s investment offering or separately. Custodial fees vary dramatically from company to company and if using a 401k this is entirely a moot point since there is no requirement for a custodian.

- Valuation– When you reach age 70.5, you are required to start taking RMDs from your IRA. If your retirement account owns Real Property, you would have to pay to get it appraised every year.

Wrong! Most custodians do not require appraisals unless the entire asset is taken as a distribution. This is a custodian-to-custodian policy not a federal requirement. In fact this subject poses a huge tax planning opportunity in that fractions of an asset taken as a distribution are not valued as a fraction of the whole, they receive a decreased valuation and therefore can save you a tremendous amount of tax with proper planning.

- Higher tax rates– When you sell real estate within an IRA, any gain distributed is taxed at ordinary income tax rates. This rate can be much higher than the capital gains rate you would pay on the sale of real estate outside of the IRA.

Wrong! Any gain on a sale will grow tax-deferred just as with any other investment. Any investment made with an IRA will be taxed at the same rate and at the same time; distribution. Only in certain situations when UBTI is an issue are IRAs taxed at the account level and prior to an RMD or other distribution. While the ordinary income tax rate may be higher than the capital gains rate you may otherwise enjoy from the sale of real estate owned outside of your IRA, you have to offset this fact with: (i) the tax-deferred treatment of the gains realized from real estate; and (ii) the tax-deferred treatment of dividends and other distributions to the IRA account as a result of income earned on the real property over the life of the investment. If you held the real estate investment outside of the IRA during the life of the investment all of the income would be taxable, rents, royalties, dividends, interest, etc.

- No Depreciation– If you purchase a building with taxable (non-IRA) funds, you get to write-off depreciation. This is not the case with an IRA.

Again, this compares property owned directly to property owned by the plan. By the way, isn’t this a clear example of one of real estate’s advantages over Wall Street’s typical offerings? You can’t depreciate a stock portfolio, but it can.

- Why not just use a REIT to buy real estate in your IRA– If you want real estate assets in your IRA for diversification, you can avoid restrictions by purchasing shares in a Real Estate Investment Trust (REIT), Real Estate ETF, or Real Estate mutual fund. These are readily available through your current investment advisor or custodian.

These are simply Wall Street’s Real Estate offerings and they can be great investments for those wanting truly passive investments. They do not contain the restrictions because they simply do not offer the same benefits of owning the property directly. Picking an asset directly and being able to actually see it, touch it and know what it is doing has great advantages over mere passive investments in other people’s real property.

Conclusion

In conclusion, we are talking apples and oranges. The previous arguments are made every day and yet they really offer no true purpose. If one is to argue whether it is best to own real estate directly or via a retirement plan I can argue there are many advantages to owning the property directly. Yes, there may be some tax exposure on investments a plan makes in real estate though typically the taxes only apply to investments that take advantage of opportunities other assets do not offer or were otherwise not immediately available to you, e.g. leveraging. Whether an investor should use his or her retirement plan to buy real estate should be a decision based upon what investment offers the best return for the plan. Whether a plan owns stocks, bonds, precious metals or real estate the taxes will be the same and therefore the investment’s risk and return should be the factors that color the investment decision.

The information presented here is only a general resource and not intended to provide tax or legal advice.

More information from IRA Advantage can be found at https://www.iraadvantage.net